nj employer payroll tax calculator

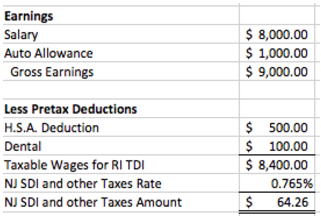

36200 2021 Taxable Wage Base TDI FLI workers only. The standard FUTA tax rate is 6 so your.

Nj Division Of Taxation Employer Payroll Tax

New Jersey unemployment tax.

. Census Bureau Number of cities with local income taxes. 138200 In accordance with NJAC. New Jersey income tax rate.

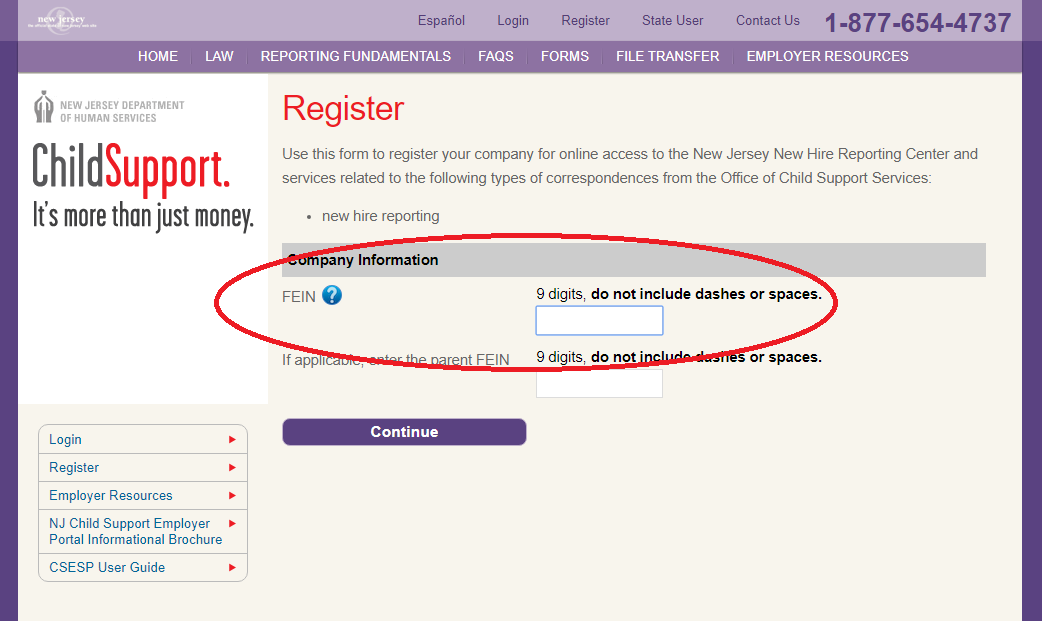

Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3. 2021 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. New Jersey Hourly Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Commuter Transportation Benefit Limits.

The steps our calculator uses to figure out each employees paycheck are pretty simple but there are a lot of them. Employees Withholding Allowance Certificate. The 1075 tax bracket became applicable from january 1 2020 for all employees who are earning gross income between 1 million and 5 million regardless of their filing.

The calculator includes options for estimating Federal Social Security. In New Jersey unemployment. Heres how it works and what tax rates youll need to apply.

Employers will also need to pay unemployment insurance or SUTA state unemployment tax. Certificate of Voluntary Withholding of Gross Income Tax from Pension and Annuity Payments. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

New Jersey Paycheck Quick Facts. PANJ Reciprocal Income Tax Agreement. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3.

Employer Requirement to Notify Employees of Earned Income Tax Credit. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey. Updated June 2022 These.

Calculate your New Jersey net pay or take home pay by entering your pay information W4 and New Jersey state W4 information. Employer Payroll Tax Electronic Filing and Reporting Options. New Jersey Gross Income Tax.

New Jersey Payroll Calculators. New Jersey announces new rate tables each year which can. The 118 tax rate applies to individuals with taxable.

The withholding tax rates for 2022 reflect graduated rates from 15 to 118. Employer Payroll Tax Electronic Filing and Reporting Options. Just enter the wages tax withholdings and other information required.

However Newark residents and any non-residents who work in Newark have to pay an additional city tax of 1.

2022 Federal Payroll Tax Rates Abacus Payroll

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Trump S Proposed Payroll Tax Elimination Itep

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Llc Tax Calculator Definitive Small Business Tax Estimator

User Guide New Jersey Child Support Employer Services Portal

Nanny Tax Payroll Calculator Gtm Payroll Services

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Tax Rate Updates For 2022 Sax Llp Advisory Audit And Accounting

The 6 Essential Payroll Tax Forms

Live And Work In Indiana But Paid Out Of Nj

Salary Paycheck Calculator Calculate Net Income Adp